A partner for long-term sustainable value.

Evergreen Solutions is a principal-focused real estate firm that acquires and manages net lease commercial properties for our own private capital stack. Our approach emphasizes deep research, disciplined underwriting, long-term ownership, and hands-on asset management to preserve and grow value.

Research & insights

Curated third-party research and market commentary relevant to net lease investing.

Institutional-quality real estate underwriting is shaped by capital markets, interest rates, and long-term credit conditions.

Principal capital. Disciplined long term, net lease investing.

Evergreen Solutions invests our own capital in net lease commercial real estate, focusing on high quality assets, strong credit and balance sheets, which allow for durable income. We underwrite with a long term ownership mindset and prioritize properties that remain essential through various investing cycles.

We invest as principals

We deploy Evergreen's own capital alongside partners, aligning incetives around downside portection, long-duration income, and carful execution.

Underwriting built for resilience

We target strong tenant credit, real estate fundamentals, unit-level performance, and lease structures designed to minimize surprises and protect cash flow.

Essential locations & long-term relevance

Our focus is on properties that matter to the tenant’s operations—everyday needs, critical services, and mission-critical use cases that stay relevant over time.

Net lease strategies built for durable income.

Evergreen Solutions focuses on net lease strategies that emphasize long-term, buy-and-hold ownership of properties leased to top-tier credit tenants, generating reliable and sustainable income.

Core Net Lease Income

Long-duration, fully net (NNN) leases to investment-grade and high-credit tenants in essential sectors. We target mission-critical assets with predictable cash flow, contractual rent escalations, and limited landlord obligations.

Enhanced Net Lease (NN)

Investments where Evergreen accepts a measured level of landlord responsibility in exchange for higher risk-adjusted returns, while maintaining strong tenant credit quality and visibility into long-term occupancy.

Essential-Use Single Tenant (N)

Single tenant properties leased to top-tier credit tenants in essential operating locations—including healthcare, logistics, and necessity-based services— where the real estate is integral to the tenant's business model.

Corporate Sale-Leaseback Program

Partnering with corporations and sponsors to unlock real estate value while securing long-term tenancy. Evergreen structures transactions that enhance balance sheet flexibility for operators and provide stable income for investors.

Sustainable Income Mandates

Bespoke net lease portfolios built around institutional objectives for duration, credit exposure, sector mix, and yield. Evergreen can tailor mandates to complement existing fixed income or real asset allocations.

Key differentiators

Common commercial lease structures

Understanding how operating costs are allocated between tenants and landlords across gross, net, and triple-net lease structures.

| Lease Type | Tenant Pays (Base Rent +) |

Landlord Pays | Key Characteristic | Common For |

|---|---|---|---|---|

| Gross | Rent (fixed) | Taxes, insurance, maintenance, utilities | Predictable, all-inclusive cost for tenant | Office, multi-tenant buildings |

| N (Single Net) | Rent + property taxes | Insurance, maintenance, utilities | Tenant covers taxes; less common | Industrial, retail |

| NN (Double Net) | Rent + taxes + insurance | Maintenance, utilities | Tenant covers taxes & insurance | Office, retail |

| NNN (Triple Net) | Rent + taxes + insurance + maintenance | Utilities (sometimes), structural repairs (rarely) | Tenant pays almost all operating costs; stable landlord income | Single-tenant retail, industrial, long-term leases |

Essential, net-leased properties backed by top-tier credit.

Evergreen Solutions targets net-leased properties with strong credit tenants in essential-use locations—assets designed to support durable, predictable income.

Representative tenant properties

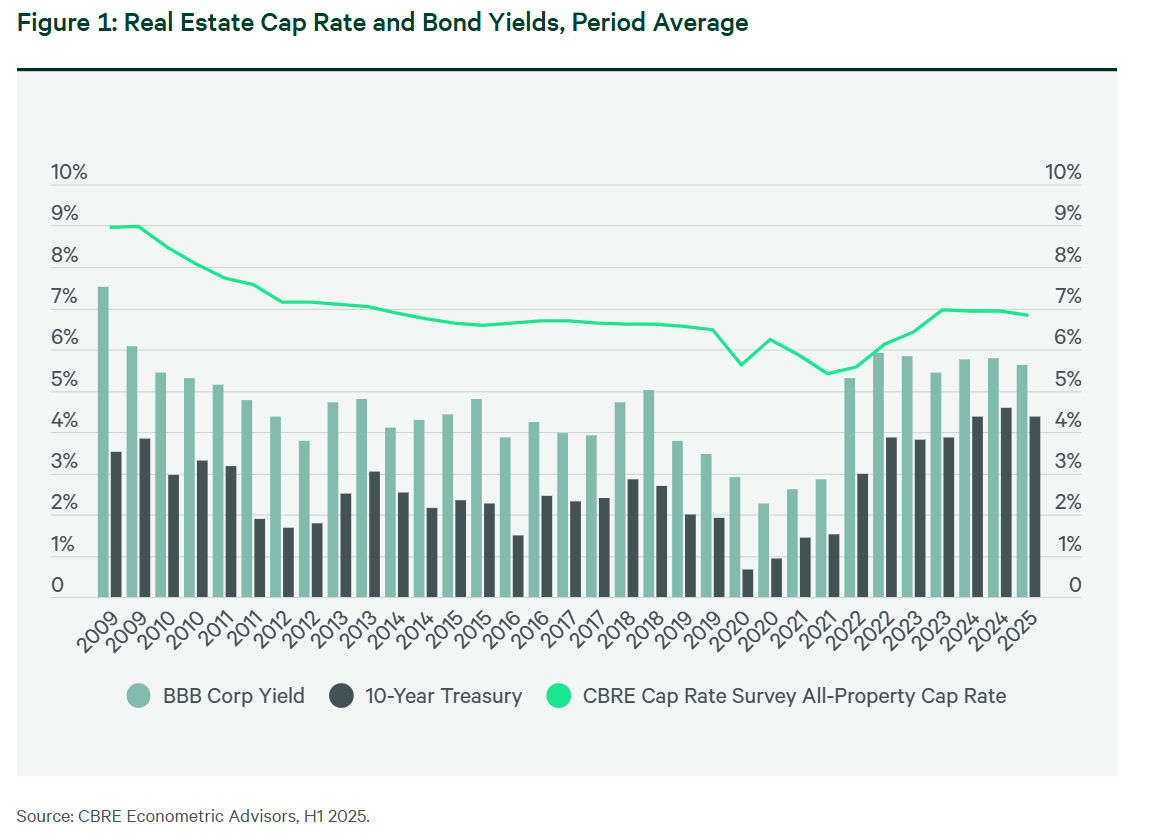

Capital Market Analysis

Historical relationships between commercial real estate cap rates, interest rates, and risk premiums across economic cycles.

Please reach out with any questions.

Whether you are building your first roadmap or scaling an established program, we can help you clarify priorities, structure initiatives, and measure results.

info@evergreensolutions.biz

Valuation, asset acquistion and disposition, and ongoing advisory services.

Phoenix, AZ